{{item.title}}

{{item.text}}

{{item.text}}

The international tax landscape is undergoing rapid change. Demands for increased transparency, as well as global minimum standards and taxes are reflected in the agendas and action plans of relevant organizations, in particular the OECD Base Erosion and Profit Shifting Project (BEPS). The EU expects to reach a consensus on the timing of implementation in June 2022, and preparations for 2023 or 2024 implementation are also underway in other countries.

The BEPS 2.0 plan is about fairer global corporate taxation. Pillar One aims to increase taxation in countries where companies with a turnover of more than Euro 20 billion and a group profitability above 10%. Pillar Two aims to prevent a "race to the bottom" competition by setting a 15% minimum tax rate on a globally defined tax base. This 15% minimum tax rate concept is also referred to as the "Global Anti-Base Erosion (GloBE)" rule. The GloBE rule applies to all companies with annual global consolidated sales of more than Euro 750 million. If a company does not reach the 15% minimum tax according to GloBE rules, a top up tax has to be paid.

Pillar One affects only about one hundred companies worldwide and is therefore not relevant for Liechtenstein. However, there will be a relevant number of Liechtenstein businesses, companies or asset structures that are directly or indirectly affected by Pillar Two. BEPS 2.0 also triggers massive tax law changes worldwide and these can also be relevant for companies not directly affected by BEPS 2.0. This is the case if a country generally increases the tax rate or introduces other measures.

GloBE rules may be implemented as early as January 1, 2023. The EU has already published a draft directive in December 2021 (but is currently debating introduction date 2023 versus 2024) and other countries such as the UK have already published draft legislation. Switzerland has published on January 13, 2022 the key figures of the planned local implementation on January 1, 2024.

A summary of the new GloBE rules can be found at BEPS 2.0: An overview of the proposal for a global minimum tax or the OECD commentary on the GloBE rules.

In July 2021, Liechtenstein expressed its willingness to participate in the OECD BEPS 2.0 plan. So far, Liechtenstein has not communicated any details regarding a possible change in the law. With a current profit tax rate of 12.5% (or lower taking into account the equity interest deduction), it is to be expected that the discussion on a tax law change in Liechtenstein will follow in the context of the GloBE rules. However, the GloBE rules are not only about a 15% minimum tax rate but also about a globally harmonized GloBE tax base. It is therefore not only a question of 12.5% versus 15% tax rate but a question 15% on what basis.

The term is very broadly defined so that all companies with a worldwide consolidated gross turnover from deliveries and services but also financial income of more than Euro 750 million for at least two of the last four tax years qualify. Thus, not only operationally active Liechtenstein companies are affected, but also holding and asset structures.

In addition to regular legal entities such as AG or GmbH, institutions, foundations or trusts are also covered by the rules. The definition of "covered persons" is very broad.

There are no exceptions for certain industries or sectors. Excluded are only:

Companies with global consolidated total revenues of more than Euro 750 million for at least two of the last four tax years must apply the GloBE rules. Relevant sales are all gross revenues including revenues from goods and services, royalties and interest income as well as investment income (capital gains and dividends from not fully consolidated companies).

For the revenue test, a "recognized" accounting standard such as IFRS or US GAAP is to be used. According to current Swiss view, Swiss GAAP FER should qualify as a recognized accounting standard, but not Swiss Code of Obligations (OR) standard. The accounting according to Liechtenstein PGR is very similar to the Swiss OR standard. It is therefore unclear whether Liechtenstein PGR accounting will meet the requirements or not. Companies that reach the Euro 750 million revenue threshold will have to prepare their financial data in a recognized standard such as IFRS, US GAAP or Swiss GAAP FER in order to comply with the GloBE rules or compliance declaration. However, for the determination of taxes in Liechtenstein, PGR financial statements will still be necessary, as the tax law explicitly does not recognize international financial statements as a basis. In addition to international and local GAAPS, consolidated data by country will also have to be prepared in accordance with GloBE in the future.

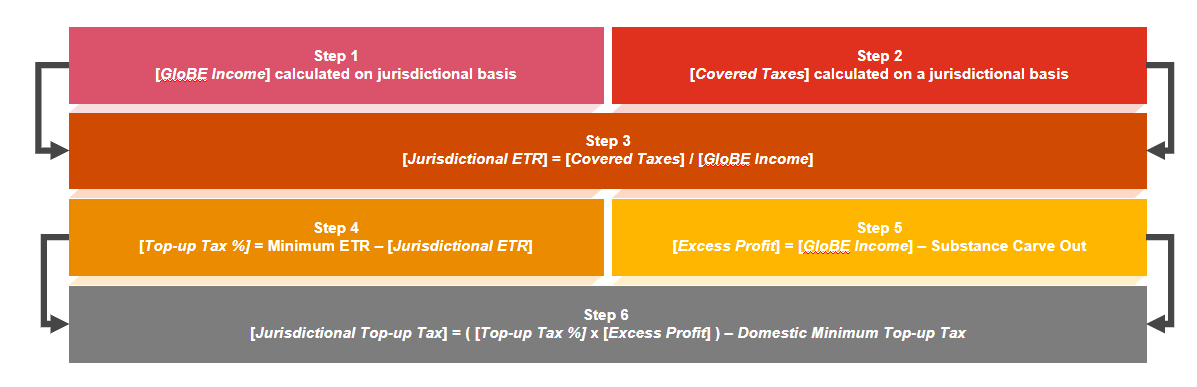

The GloBE calculations can be summarized in the six steps outlined below. Companies that fall under the GloBE rules need to prepare around 170 data points (consolidated by country) in order to be able to effectively assess the GloBE rules. The data from country-by-country reporting is a good first indicator but is far from sufficient to cover the GloBE rules.

In order to determine the GloBE tax base in a first step, a number of GloBE adjustments have to be made by the recognized accounting standards, so that the companies have to first prepare a per country consolidated financial statement according to the GloBE standard.

Without a detailed interaction of systems, accounting standard, accounting, tax and tax accounting as well as IT and governance, it will hardly be possible to apply the GloBE rules. Affected companies will have to adapt to another GloBE standard for accounting and taxes and prepare an automation of data and reconciliations. Very few companies and their systems today can effectively determine the data relevant for GloBE and costly IT projects will be necessary.

Additional Compliance Requirements

Each group covered by the GloBE rules must file a GloBE Information Return within 15 months (18 months for the first GloBE tax return) after the end of the tax year.

The following selected aspects are of interest from a Liechtenstein perspective:

As the above non-exhaustive list shows, there are various aspects of Liechtenstein tax law which need to be reconsidered in the light of the GloBE rules. Therefore, to remain competitive on the one hand and to avoid that GloBE tax substance is appropriated by other countries on the other hand, Liechtenstein will not be able to avoid a tax policy debate and tax law amendments.

Every company, regardless of whether it is operationally active, has a private asset structure, is an investment vehicle or fund, bank or insurance company, is well advised to deal with this topic and to actively address it at the highest level of management.

Further exciting details on this topic can be found on PwC BEPS 2.0.

#social#